Still of the mindset that your business is doing just fine accepting traditional payment methods, which may include cash only, or an affixed point-of-sale system? The following perspectives underscore how much of an impact mobile payments can stand to make on your restaurant’s bottom line.

1. Mobile Payments Will Soon Be The New Norm

Though mobile payment adoption levels in the United States have lagged compared to those in Europe and Asia, provider consolidations, new entrants to the space and enhanced ease of use have created a renewed sense of optimism for payments and mobile wallets. The New York Times recently cited new research from Forrester predicting that mobile payment will experience a particularly rapid expansion over the next five years, reaching $91 billion in volume in the United States alone by 2019.

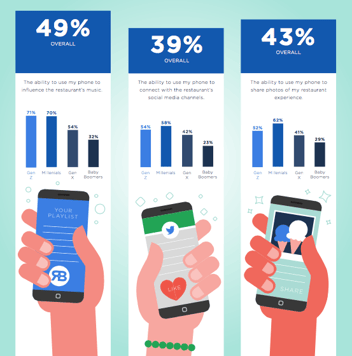

2. The Majority Of Adults Use Mobile Restaurant Technology

Despite the age or income level of your customer base, more than half of the American population now owns a smartphone. Further, those users are particularly open to the notion of incorporating the technology into their dining experience. In fact, a 2013 study conducted by the National Restaurant Association (NRA) indicated that 63 percent of adults surveyed had used some form of restaurant-related technology in the past month; 46 percent of adults said they would use a smartphone to make a restaurant reservation or place an order at a touch-screen kiosk if the option existed. Because mobile payments are a natural extension to those restaurant-based mobile behaviors, the amount of consumer “education” restaurants must invest in the benefit of using a mobile payment option is minimal.

3. Mobile Offers The Simplified Experience Consumers Want

Regardless of your menu offering, culinary style, or quality of the food you serve, diners expect a convenient and seamless restaurant experience that fits their constantly changing needs. Given that the same customer may want a fast take-out experience on one day, but a dining room experience the next, mobile payments allow restaurants to accommodate a range of customer demands, while at the same time empowering customers. With mobile payments, consumers can complete an order without having to wait in a checkout line or even interact with a server to complete payment. In NRA’s survey, 43 percent of respondents between the ages of 18 to 34 said they would welcome the ability to use their smartphone to pay for their meal.

4. The Mobile Payment Trend Is Catching On With Restaurants

The willingness of leading restaurant brands to incorporate new payment technologies into their operations speaks to the mobile payments opportunity restaurants of all sizes can seize. In early 2014, for example, Open Table, the largest online reservation service, released pilot programs to test mobile payment options within its app in larger markets like San Francisco and New York. As reported by Business Insider, major fast food chains like McDonald’s, Taco Bell, Chipotle and Wendy’s have similar initiatives underway. On the heels of such larger brands, the NRA’s data indicates that smaller restaurants are preparing to compete. In the study, 54 percent of table service and 48 percent of quick service operators reported plans to invest more resources into mobile technology within the year.

5. Mobile Payments Are Increasing Customer Loyalty

The degree of repeat business and purchase frequency you’re able to leverage from customers can mean the difference between profit margins or financial instability. Mobile technology makes it simple to incorporate rewards for customer purchases, including points-based programs, earned discounts, fun mobile experiences, and free offers, which customers repeatedly indicate play a role in their purchase decisions. In NRA’s survey, half of all consumers said they would use restaurant rewards and special deals offered to them by way of a smartphone. (Even more significantly, 70 percent of respondents 18 to 34 said they would use them.) Starbucks reportedly generates at least $1 billion in revenue thanks to its mobile payment app, which also includes a customer loyalty component.

We would love to hear your questions and feedback in the comments! Tell us how you're utilizing mobile, payment technologies and other new products to stay ahead of your competition and engage today's customers.

Kristen Gramigna is Chief Marketing Officer for BluePay, a credit card processing firm, and also serves on its Board of Directors. She has more than 15 years experience in the bankcard industry in direct sales, sales management, marketing, and helping small businesses succeed.